How Are Your Social Security Retirement Benefits Calculated?

Whether you are counting the days to your retirement or just want to be educated about it as early as you can, it’s good to be informed of how your social security retirement benefits are calculated beginning 2018

The formula is based on a few variables. Basically. It takes the 35 years that you have earned the highest into account. It also takes into consideration your full retirement age as well as the age at which you decide that you will start collecting your retirement benefit.

Beginning 2018, this is how the calculation works and how an early retirement or a late retirement could affect your benefits.

Primary Insurance

If you are already receiving your Social Security benefits, this method will not recalculate your 2018 benefit. However, your current monthly compensation will be adjusted to the cost-of-living-adjustment or COLA for 2018.

Those who are about to receive their Social Security retirement benefits for the first time must first determine their primary insurance amount or PIA, as the first step in calculating the SS benefits. This amount is the amount of their monthly Social Security retirement benefit if they are to receive it at their full retirement age or the normal retirement age.

Calculation Method for Social Security Retirement Benefits for 2018

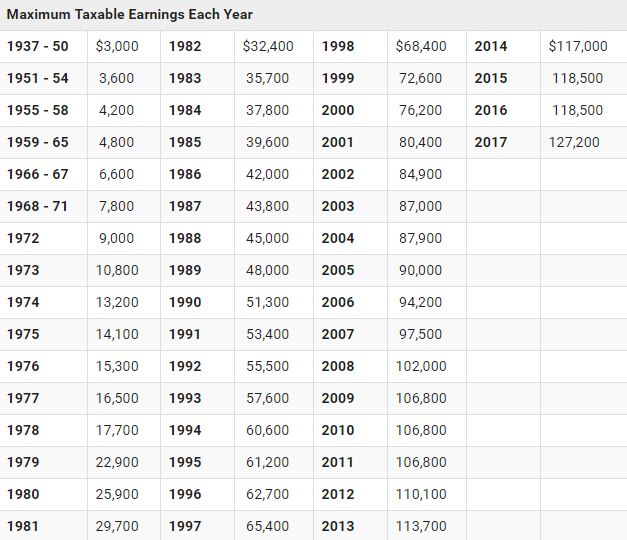

- First, the Social Security Administration will make a list of your annual earnings. This is up to the maximum taxable wages for each year.

- Each year is listed for inflation and they will average the top 35 years together and then divide it by 12. The final figure is the average listed monthly earnings for you.

- Your average indexed monthly earning will be applied to a formula that will calculate your personal insurance amount or PIA.

- In 2018, the formula is 90% of the average listed monthly earning from the first $896.

- 32% of the amount from $896 to $5,399 and 15% of the amount exceeding $5,399.

The Full Retirement Age

If you’re not sure what your full retirement age is, there is an easy way to determine this. Depending on the year that you were born, your full retirement age is between 66 and 67. But in 2018, the full retirement age for people who were born in 1956 is 66 years and 4 months for them to be eligible for Social Security retirement benefits.

Guide

Take a look at this guide to find out what your full Social Security retirement age is.

People who were born in:

- 1954 or earlier – 66

- 1955 – 66 years and 2 months

- 1965 – 66 years and 4 months

- 1957 – 66 years and 6 months

- 1958 – 66 years and 8 months

- 1959 – 66 years and 10 months

- 1960 and later – 67 years

If you would like to receive your benefits before or after your full retirement age, your monthly compensation will be affected.

Let us look at how they are calculated.

Early Retirement

Americans who are eligible for Social Security retirement benefits are allowed to start collecting their monthly retirement compensation at any time from the age 62 to 70. Choosing to start before your full retirement age will permanently affect your benefits.

If you start early, your benefits will be reduced by certain percentages depending on how early you choose to claim them. Your PIA will be reduced at rate of 6 2/3% per year for the first 36 months. If you start more than 36 months early, this amount will go even lower.

Late Retirement

On the other hand, if you start your Social Security retirement benefits after your full retirement age, your PIA will naturally increase. For every year you don’t claim them, you will receive a permanent 8% boost but you can only delay it until age 70.